Aggregate Deductible Insurance Definition

Definition aggregate deductible — the maximum amount the insured can pay as deductibles over a specified period, typically 1 year. An aggregate deductible is the limit deductible a policyholder would be required to pay on claims during a given period of time.

Insurance As A Risk Management Technique Policy Provisions Chapter 7 - Ppt Video Online Download

The aggregate specific deductible covers the entire group and must be satisfied before an employer can get reimbursed.

/GettyImages-1029298450-195365e2e74a463696e5629cdfa815f7.jpg)

Aggregate deductible insurance definition. In most cases these high deductible plans have an aggregate deductible. Definition aggregate stop‐loss asl, agg aggregate stop‐loss insurance provides a maximum claim liability for the entire group. Offers protection to the insured from a high frequency of losses;

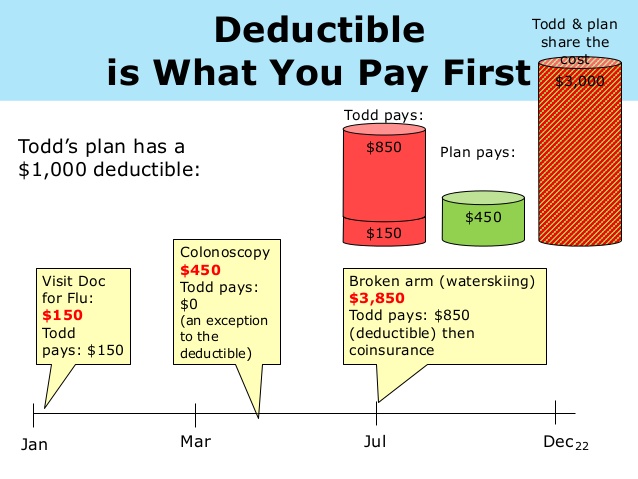

There are two kinds of deductibles: You will only pay one deductible amount for the entire policy period, regardless of the number of claims. Subsequently, coverage kicks in, and.

$2000 $2,000 $4000 parent 2: Traditional and managed care plans have deductibles and coinsurance (a percentage that the insured pays. Aggregate also is referred to as an aggregate limit or general aggregate limit.

In other words, if a policyholder files several claims or one large claim, they must pay out of pocket up to a certain dollar sum. The insured would have had to normally pay $15,000 as a deductible. Sometimes called annual aggregate deductible.

The annual aggregate deductible (aad) enables an insured to protect itself from numerous small claims by limiting the amount of deductible they pay per policy year. $950 hdhpi family does not meet their deductible embedded deductibles ppo and hdhp2 plans parent 2: This means that the deductible for all persons covered on the plan must.

The term aggregate refers to the total limit which an insurance policy may potentially pay out in a policy period. (aggregate annual deductible) a form of per risk excess reinsurance under which the primary company retains its normal retention on each risk and additionally retains an aggregate amount of the losses which exceeds normal retention. Alien company an insurer or reinsurer domiciled outside the u.s.

In other words, if a policyholder files several claims or one large claim, they must pay out of pocket up to a certain dollar sum. An aggregate annual deductible is the maximum amount policyholders need to pay within a policy period before their insurer pays for covered losses. An aggregate deductible is often part of product liability policies or family health insurance policies, and any other policies that might result in a large number of claims during a specific period.

Aggregating specific corridor aggregating specific deductible, aggregating spec this contract provision is often offered in tpa arrangements. An aggregate limit is a maximum amount an insurer will reimburse a policyholder for all covered losses during a set time period, usually one year. This is in addition to the specific deductible that is already in place.

In insurance terms, aggregate refers to the limit a policy will pay during a specified timeframe. How it works this example shows an employer with a: An aggregate deductible places a limit on the amount a policyholder pays for a claim before the insurance company covers the rest of the loss.

$200,000 specific deductible $60,000 aggregate specific deductible Once the insured has paid losses up to that amount, the insurer pays the remainder of losses for the annual period without seeking reimbursement from the insured. Aggregate deductibles are most likely to be features of product.

An aggregate deductible means that the entire family deductible must be paid out of pocket before the company pays for services for one family member. A policy would start to pay benefits once the agreed aggregate amount is reached. The policy contract defines your coverage limits, parameters, and policy period.

$3,500 aggregate deductible hdhpi medical bills for the year parent 2: Aggregate deductible funds (adfs) are becoming a more common type of insurance alternative for buying groups who are looking for new ways to manage their risks. What is an aggregate retention?

There are several forms of health insurance to consider buying for your family. An aggregate annual deductible is the maximum amount policyholders need to pay within a policy period before their insurer pays for covered losses. Most policy periods are one year.

Insurance policies typically set caps on both. What is an aggregate deductible fund? A type of deductible that applies for an entire year in which the insured absorbs all losses until t

Ch10 Analysis Of Insurance Contracts Ch6 In 11th Ed - Ppt Download

Chapter 10 Analysis Of Insurance Contracts Agenda Basic

Analysis Of Insurance Contracts - Ppt Download

Ch 10 Analysis Of Insurance Contracts Ch 6

Lecture No 19 Analysis Of Insurance Contracts Agenda

Boot Camp On Reinsurance Pricing Techniques Loss Sensitive Treaty Provisions July Ppt Download

What Is A Deductible Heres How A Deductible Works When You Get A Health Insurance Plan Deductible Whatis Health Insurance Plans Health Insurance Deduction

True Family Embedded Deductibles - Types Of Deductibles Bcbs Wny

Embedded Deductibles Source Of Consumer Confusion - Center On Health Insurance Reforms

Pdf Analysis Of Insurance Contracts Muhammad Salman - Academiaedu

Chapter 6 Analysis Of Insurance Contracts Agenda Basic

Chapter 6 Analysis Of Insurance Contracts Agenda Basic

True Family Embedded Deductibles - Types Of Deductibles Bcbs Wny

Ch 10 Analysis Of Insurance Contracts Ch 6

Chapter 10 Analysis Of Insurance Contracts Agenda Basic

/GettyImages-1029298450-195365e2e74a463696e5629cdfa815f7.jpg)

Aggregate Deductible Definition

Insurance Alternatives Part 3 Aggregate Deductible Funds The Fold Legal

Posting Komentar untuk "Aggregate Deductible Insurance Definition"