Bank Owned Life Insurance Accounting

The cash surrender values of boli were $21.4 million and $21.7 million as of december 31, 2011 and 2010, respectively. The policy account will be debited by the amount.

The company (or bank) pays the premium on the insurance, but is also the policy beneficiary.

Bank owned life insurance accounting. A life insurance contract provides an accumulated contract value that increases over time and an additional return upon the death of the insured. Bank owned life insurance (boli) uses tax advantages to create an efficient way to offset employee benefit costs for banks and credit unions. The safe and sound use of boli depends on effective senior management and board oversight.

If not, what classification is more appropriate and why? Bank owned life insurance (boli) bank owned life insurance (boli) is defined as a company owned insurance policy on one or more of its key employees that will informally fund the financing of employee benefits programs. Banks use it as a tax shelter and to fund employee benefits.

A bank will purchase and own a life insurance policy on an executive or group of executive’s lives and the bank is listed as the beneficiary of the policy. These are types of life insurance policies taken out by a company (or a bank) on the lives of key employees. $5,000 life insurance income account:

The ability of state chartered banks to purchase life insurance is governed by state law. This, of course, is done within the context of a legitimate business reason for a bank owning life insurance. For this purpose, it is better to provide an amount equal to the difference between the surrender value of the policy and the amount of debt so due out of profits and transfer the debtors’ balance to a policy account.

The bank purchases and owns an insurance policy on an executive’s life and is the beneficiary. Yes, tic supports classifying cash proceeds received from the settlement of corporate‐ owned life insurance policies as cash inflows from investing activities. At purchase, a stated maturity value

As an asset on the bank’s There are several types of life insurance. However, with respect to this.

It can help banks deliver on benefit promises made to employees and enable them to provide more competitive benefit programs while containing costs. Life insurance premium expense account: $3,200 conclusion the use of life insurance may be a key financial decision for your business.

It can help banks deliver on benefit promises made to employees and enable them to provide more competitive benefit programs while. Understanding its impact on the financial statements of your business is an important element in making a decision on the use of a business owned life insurance policy. The code states that the entity should record the amount that it

While any insurance owned by a bank can be referred to as boli, the term is most often applied to insurance marketing programs in which life insurance is offered to a bank specifically as an opportunity for the bank to take advantage of tax deferred cash value growth. Insurance policies, including bank‐owned life insurance policies, be classified as cash inflows from investing activities?

/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank-owned Life Insurance Boli

5 Stocks Flows And Accounting Rules In Monetary And Financial Statistics Manual And Compilation Guide

Understanding Sipc And Fdic Coverage Ameriprise Financial

Corporate Owned Life Insurance - Overview - Mullin Barens Sanford Financial And Insurance Services Llc

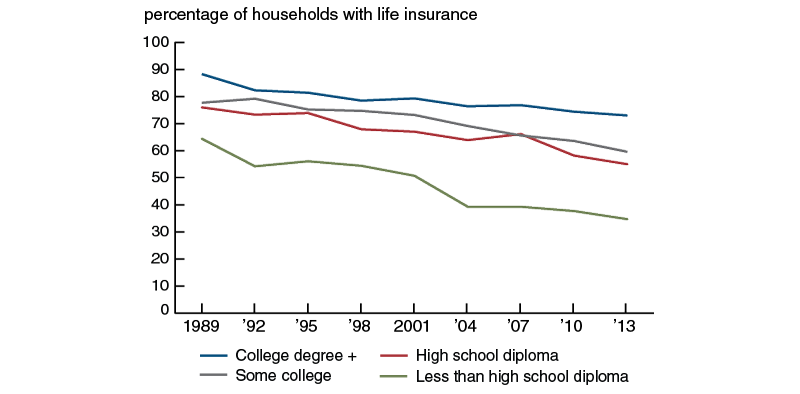

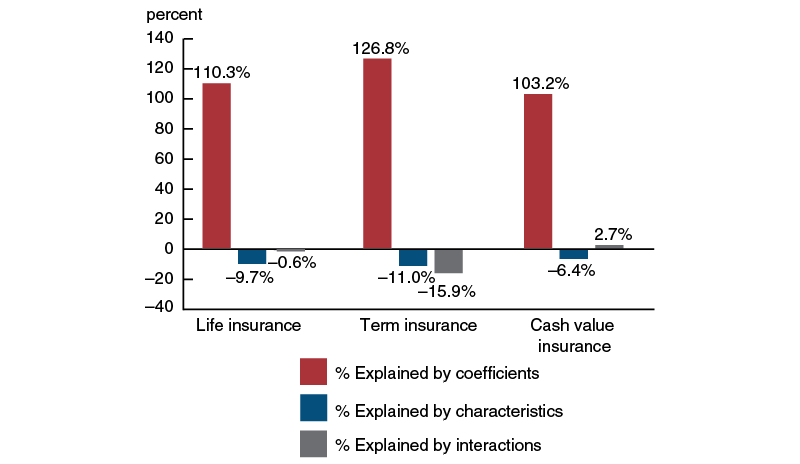

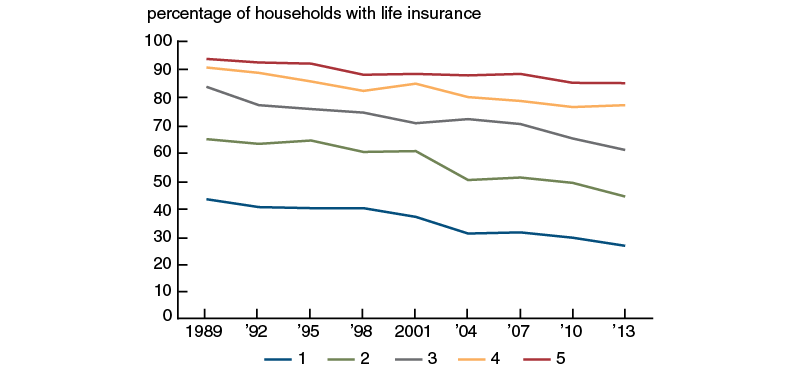

What Explains The Decline In Life Insurance Ownership - Federal Reserve Bank Of Chicago

What Explains The Decline In Life Insurance Ownership - Federal Reserve Bank Of Chicago

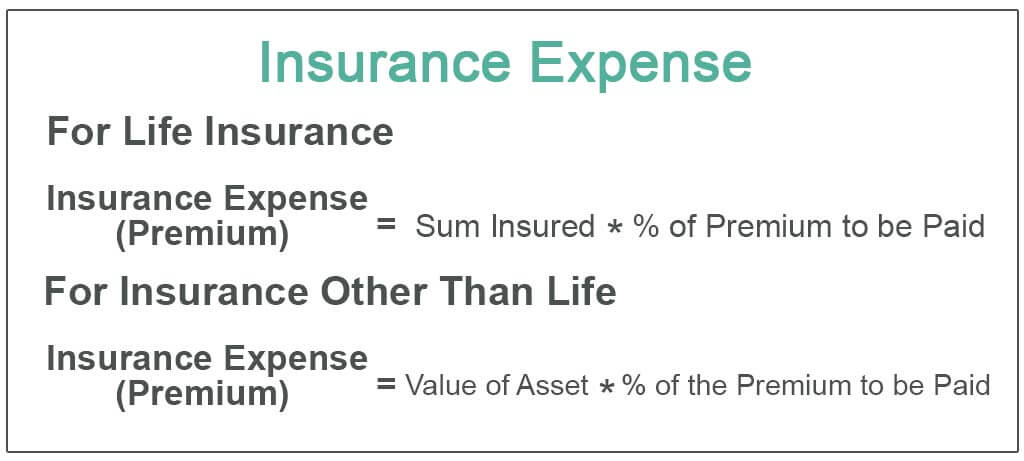

Insurance Expense Formula Examples Calculate Insurance Expense

Top 10 Pros And Cons Of The Infinite Banking Concept 2021 Edition How To Become Your Own Banker With Life Insurance

Deposit Accounting - Definition Types Journal Entries

Chart Of Accounts In Accounting In 2021 Chart Of Accounts Bookkeeping And Accounting Accounting

11-myths-about-life-insurance Life Insurance Quotes Life Insurance Life Insurance Policy

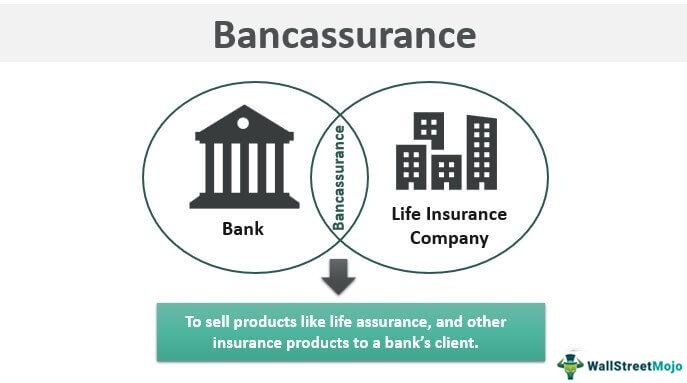

Bancassurance Meaning Types What Is Bancassurance

What Explains The Decline In Life Insurance Ownership - Federal Reserve Bank Of Chicago

:max_bytes(150000):strip_icc()/GettyImages-514211407-7890c9f9232844d1863ab073895a7c6f.jpg)

Bank-owned Life Insurance Boli

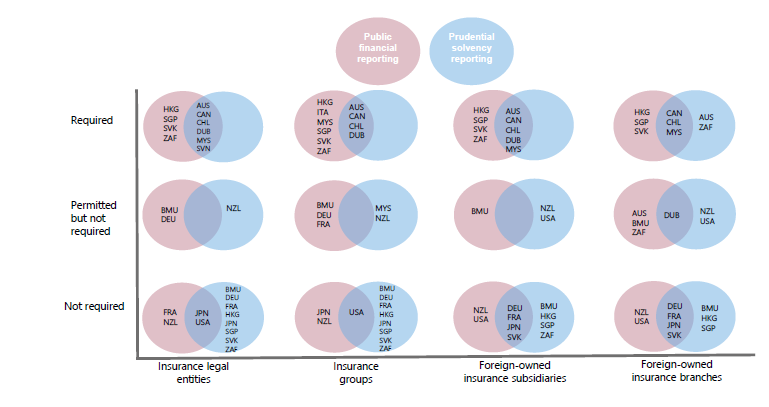

Ifrs 17 Implications For Supervisors And The Industry Access To Insurance Initiative

Corporate Owned Life Insurance - Overview - Mullin Barens Sanford Financial And Insurance Services Llc

Mengenal Istilah Dalam Dunia Asuransi Versi Allianz Indonesia

Posting Komentar untuk "Bank Owned Life Insurance Accounting"