Bank Owned Life Insurance Tier 1 Capital

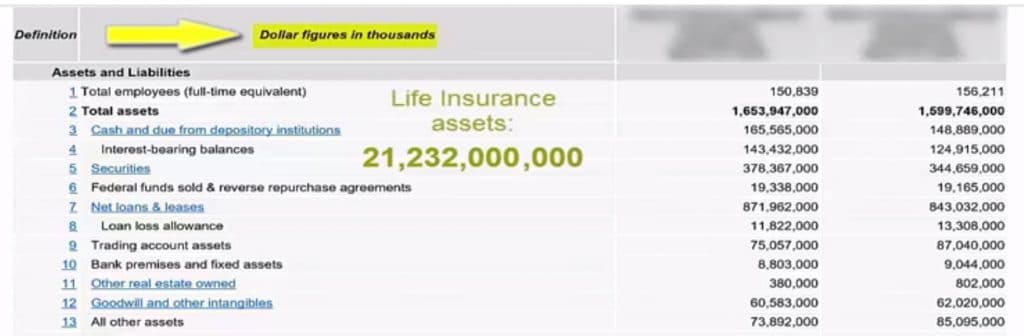

Only in the number of community banks reporting life insurance assets but also in the balances outstanding and the level of the concentration of life insurance measured as a percentage of tier 1 capital plus the allowance for loan and lease losses (alll). Banks continue to keep the life insurance policies on retired or separated executives as the rate of return on this kind of arrangement is much higher when it is held for a long time.

What Is Boli Or Bank Owned Life Insurance Livingwealthcom

Bank owned life insurance to tier 1 program !

Bank owned life insurance tier 1 capital. What percentage of the bank’s tier 1 capital is currently tied to insurance? Before purchasing boli, a bank’s board and senior management should understand the risks, rewards, and characteristics of boli. Treasuries since the federal reserve dropped rates to zero.

A valid business purpose must be identified, such as offsetting employee retirement and benefit obligations. A bank will purchase and own a life insurance policy on an executive or group of executive’s lives and the bank is listed as the beneficiary of the policy. Tier 1 capital represents a bank’s equity and reserves.

This plan is similar to what large corporate investors do when they purchase key person whole life policies for A bank will purchase and own a life insurance policy on an executive or group of executive’s lives and the bank is listed as the beneficiary of the policy. If it is a separate account policy, the bank may use a “look through” approach to the underlying assets for the appropriate risk weight, which in no event can be less than 20%.

Community banks have traditionally been reluctant to buy life insurance on key employees, a common practice among big banks. Where ineffective controls over boli risks exist, or the exposure poses a safety and soundness concern, supervisory action against the institution, may. As with personal life insurance, death benefits are not calculated as “yields,” although they can provide significant additional financial value to beneficiaries, including spouses, children, charities, alma maters, and employers.

(fdic is tier 1 capital only) •when considering a boli transaction the regulators require a bank to insure that the transaction complies with its legal lending limit and concentration of credit limit. The insurance offers tax breaks and counts as tier 1 capital, while producing higher yields than most tier 1 investments. The technique allows a bank to invest tier 1 capital into bank owned life insurance policies insuring the life of bank employees.

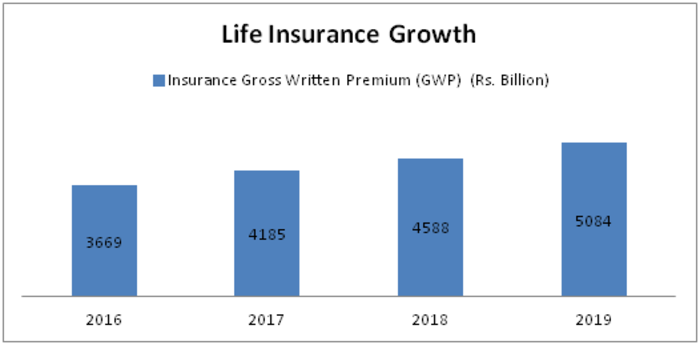

There are likely many reasons for the increase in boli balances. The case for investing in life insurance | medical economics. Banks may potentially use up to 25% of tier 1 capital for boli (15% with any one carrier

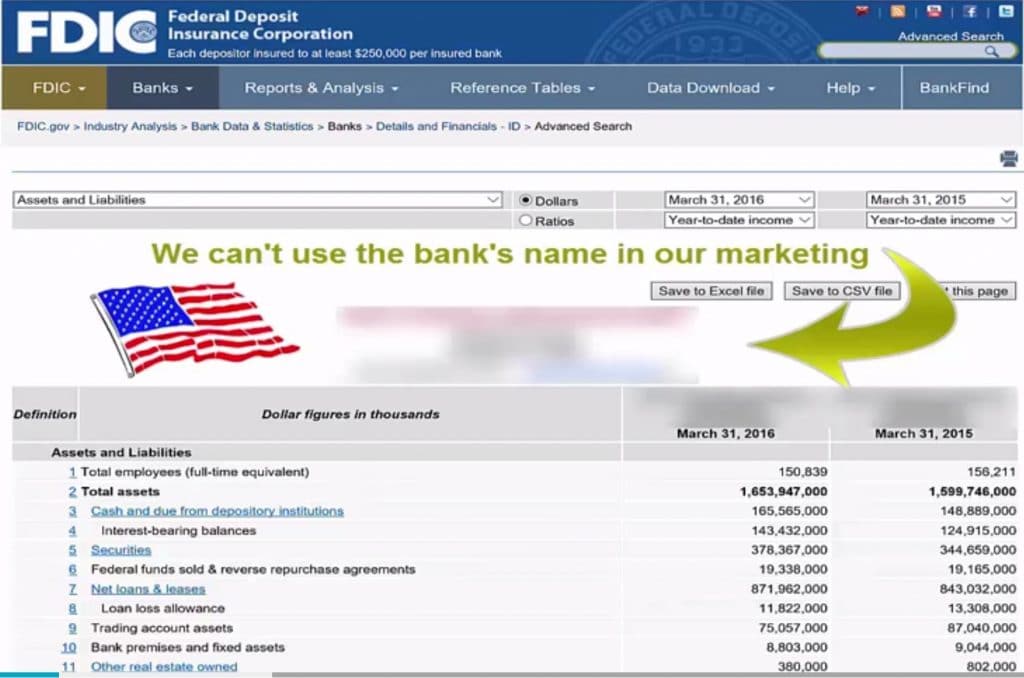

Banks may potentially use up to 25% of tier 1 capital for boli (15% with any one carrier for general account boli), less an allowance for loan loss reserves. I think it is called tier 1 capital on their balance sheet, there is a website you can look it up. In fact, banks can invest up to 25% of their tier 1 capital in boli.

The boli transaction involves a reallocation of tier i capital assets. More may be obtained subject to applicable regulations 5. Banks may hold up to 25% of regulatory capital (tier 1) in boli.

It includes common stock (plus related surplus) and retained earnings plus limited amounts of minority interest in the form of common stock, less the majority of the regulatory deductions and adjustments described. Can have as much as 25% of tier 1 capital tied to insurance; It is a different product, but based on the same general acct.

Offsetting employee retirement and benefit obligations. An institution holding life insurance in a manner inconsistent with safe and sound banking practices is subject to supervisory action. Therefore, the fdic expects an institution that plans to acquire boli in an amount that results in an aggregate csv in excess of this concentration limit, or any lower internal limit, to gain prior approval from its board of directors or the appropriate board committee.

A bank may have no more than 15% of tier 1. Assume that a bank has an average tier i capital earnings rate of 5%. Bank normally uses less than 25% of tier 1 capital to fund the bank owned life insurance policies.

The definition of capital is revised to include common equity tier 1 capital as well as additional tier 1 capital (t1); Bank owned life insurance (boli) uses tax advantages to create an efficient way to offset employee benefit costs for banks and credit unions. Examines the industry's concentration of assets in boli holdings relative to capital.

And tier 2 (t2) capital. Common equity tier 1 (cet1) capital is a new concept. Many banks own 15% to 25%.

The bank sells $1 million worth of its taxable portfolio and uses the proceeds to pay for a single premium boli The purpose of the program is to provide investors with a net present value death benefit hedge against possible loss of value for community bank stock. It is advisable to use top 30% bank executives to avoid any potential income tax consequences.

Bank owned life insurance tier 1 capital. It is generally not prudent for an institution to hold boli with an aggregate csv that exceeds 25 percent of its tier 1 capital. Approaches or exceeds 25 percent of tier 1 capital.

To emphasize earnings, policies are structured to maximize investment aspects and minimize expense of death benefit portion of policy.

How Big Banks Invest Their Safe And Liquid Reserves - Banking Truths

Boli Explained Paradigm Life Blog Post

How Big Banks Invest Their Safe And Liquid Reserves - Banking Truths

Insurance Agents Guide To Bank Owned Life Insurance - Redbird Agents

Distributions From S Corps Can Fund Life Insurance Premiums - Bsmg Brokers Service Marketing Group

How Big Banks Invest Their Safe And Liquid Reserves - Banking Truths

Boli Bank Owned Life Insurance The What And The Why

Hdfc Life Seven Key Facts On Hdfc Life Buyout Of Exide Life Insurance Bfsi News Et Bfsi

Bank Owned Life Insurance Or Boli For Better Investment Returns

/hsbc-branch-in-new-bond-street--london-533780165-ff99ebc393c243cba463ea80559836b0.jpg)

Bank-owned Life Insurance Boli

:max_bytes(150000):strip_icc()/GettyImages-514211407-7890c9f9232844d1863ab073895a7c6f.jpg)

Bank-owned Life Insurance Boli

How Big Banks Invest Their Safe And Liquid Reserves - Banking Truths

Understanding Why Life Insurance Is An Asset For Growing Wealth

Bank-owned Life Insurance Boli

Boli Bank Owned Life Insurance The What And The Why

How Big Banks Invest Their Safe And Liquid Reserves - Banking Truths

Boli Bank Owned Life Insurance The What And The Why

Posting Komentar untuk "Bank Owned Life Insurance Tier 1 Capital"