How To Calculate Fdic Insurance Coverage

If you still can’t wrap your head around how coverage limits apply to different accounts, you can calculate the amount of protection you’ll receive by using one of the following tools from each of the two federal agencies: If the owner names more than five beneficiaries, it becomes more complicated.

Advisorselect - Deposit Insurance At A Glance

In response, the deposit insurance telephone seminar is designed to explain the basic information bank employees need to assist their customers in.

How to calculate fdic insurance coverage. Get the best quote and save 30% today! Refer to the fdic reference if. Other ways to protect your savings.

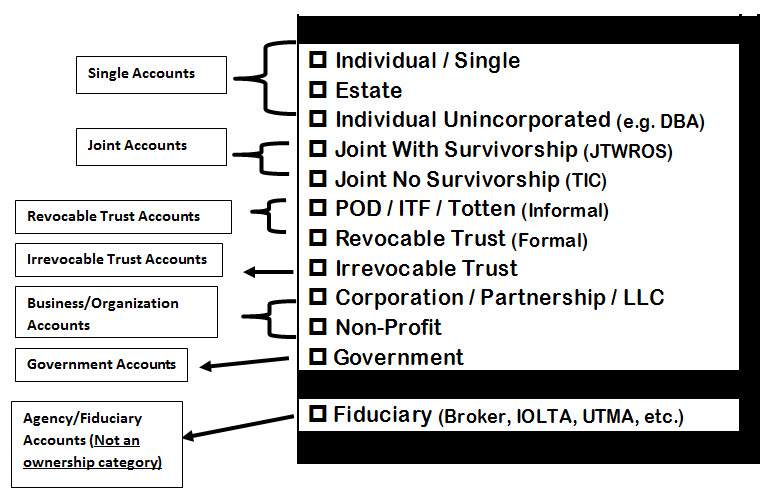

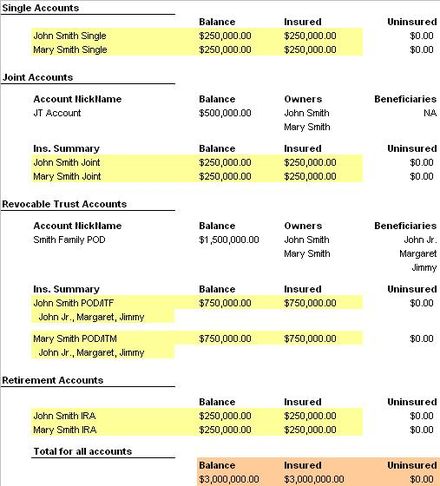

In determining the deposit insurance coverage, we first must calculate the coverage based on actual interests: The fdic insures up to $250,000 per depositor, per institution and per ownership category. Enter all of your personal, business and government accounts for that bank, then go through all three steps.

Savings accounts (both statement and passbook) money market deposit accounts (mmdas), and. Generally, a problem bank is defined as one considered to be in financial difficulty based on an analysis of various factors, including liquidity, capital. Ad compare top expat health insurance in indonesia.

Despite a dramatic drop in the number of failures, the number of banks on the fdic’s problem bank list remains a concern. You can use the fdic’s electronic deposit insurance estimator (edie) tool to determine the amount of insurance coverage you have for all types of bank accounts. Ad compare top expat health insurance in indonesia.

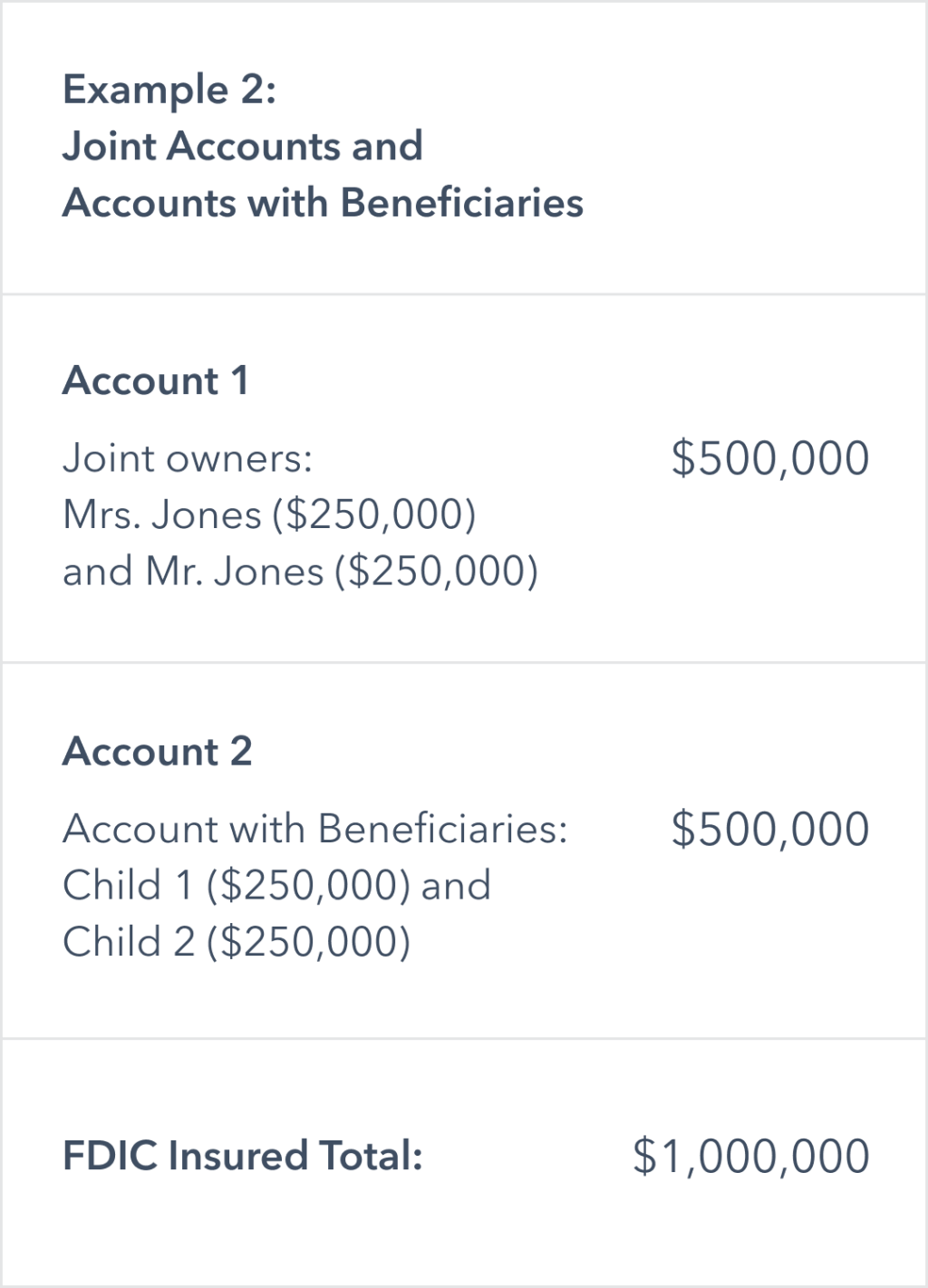

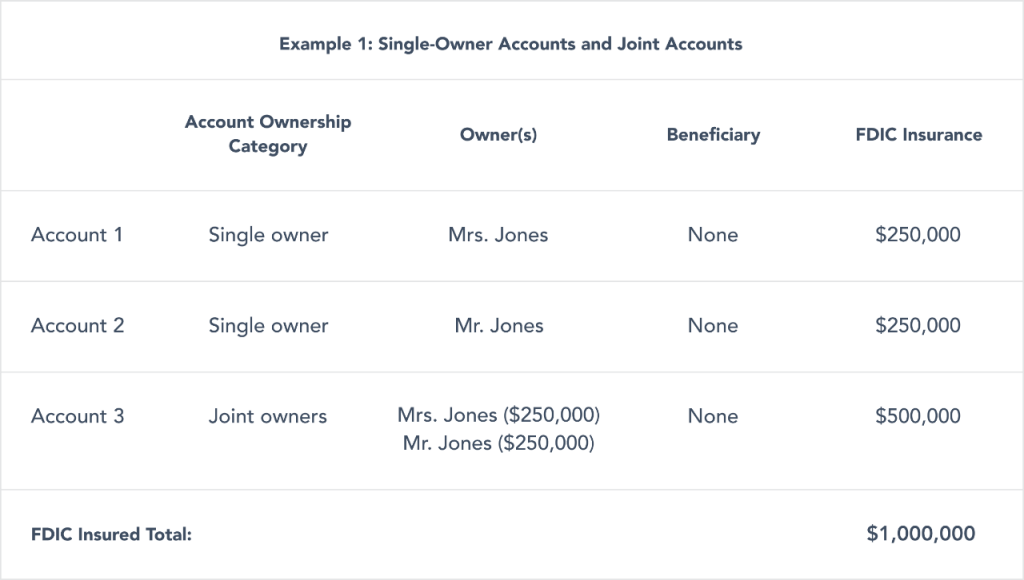

The standard insurance amount is $250,000 per depositor, per insured bank, for each account ownership category. Fdic insurance covers deposit accounts — checking, savings and. First, you can deposit your money at different banks.

Fdic’s electronic deposit insurance estimator (edie) ncua’s electronic share insurance calculator (esic) The fdic receives thousands of inquiries each month from depositors, bank employees and other financial industry personnel about how to calculate fdic deposit insurance coverage. Since the fdic insurance limit of $250,000 is per ownership category at each bank, you can easily maximize your coverage in one of two ways.

When your report for the first bank is complete, start back here with your next bank and so on, until you have a report for each. The amount attributable to the first beneficiary is $700,000 ($1,400,000 x 50%). $250,000 times 6 is $1.5 million).

Edie can be used to calculate the insurance coverage for: So, for example, if a father names a child the sole beneficiary in a living trust account worth $230,000 and also names him as sole beneficiary of a pod account with a $40,000 balance, the $20,000 exceeding the $250,000 limit would be uninsured. Edie lets you know exactly how the insurance rules and limits apply to your specific deposit accounts including what's insured and what portion (if any) exceeds coverage limits.

The fdic provides separate coverage for deposits held in different account ownership categories. To calculate the deposit insurance coverage, multiply $250,000 times the number of owners times the number of unique eligible beneficiaries. Consumers can also learn how the insurance rules limits apply to your specific deposit accounts.

That means a trust set up by 2 parents for their 3 kids is insured for up to $1.5 million (2 parents times 3 kids is 6; The calculator will determine the amount of fdic insurance coverage a person and their family have based on the amounts they have on deposit and the ownership of those deposits at each bank or. These calculators can be downloaded and used to estimate insurance assessment rates for future quarters.

How to get more fdic coverage it’s actually relatively easy to increase your fdic coverage. Calculate insurance coverage—use the fdic’s online electronic deposit insurance estimator at: Get the best quote and save 30% today!

What you need to know to calculate deposit insurance coverage. Read more about fdic insurance online—visit: The fdic has made a tool available called the electronic deposit insurance estimator (edie).

Depositors may qualify for more coverage if they have funds in different ownership categories and all fdic requirements are met.

Maximizing Your Fdic Coverage With Beneficiaries

Fdic Bank Insurance Marcus By Goldman Sachs

Fdic Deposit Insurance At A Glance

How Fdic Insurance Works Synchrony Bank

Fdic Financial Institution Employees Guide To Deposit Insurance - General Principles Of Insurance Coverage

Comprehensive Deposit Insurance Seminar For Bankers Important This

Erie Bank - Fdic Insurance Coverage

Federal Deposit Insurance Corporation Deposit Insurance Coverage For

Advisorselect - Deposit Insurance At A Glance

Fdic Transparency Accountability - Deposit Insurance For Bankers

Comprehensive Deposit Insurance Seminar For Bankers Important This

Fdic Insurance Limits Fdic-insured Bank St Paul Mn Drake Bank

Federal Deposit Insurance Corporation - Wikiwand

Comprehensive Deposit Insurance Seminar For Bankers Important This

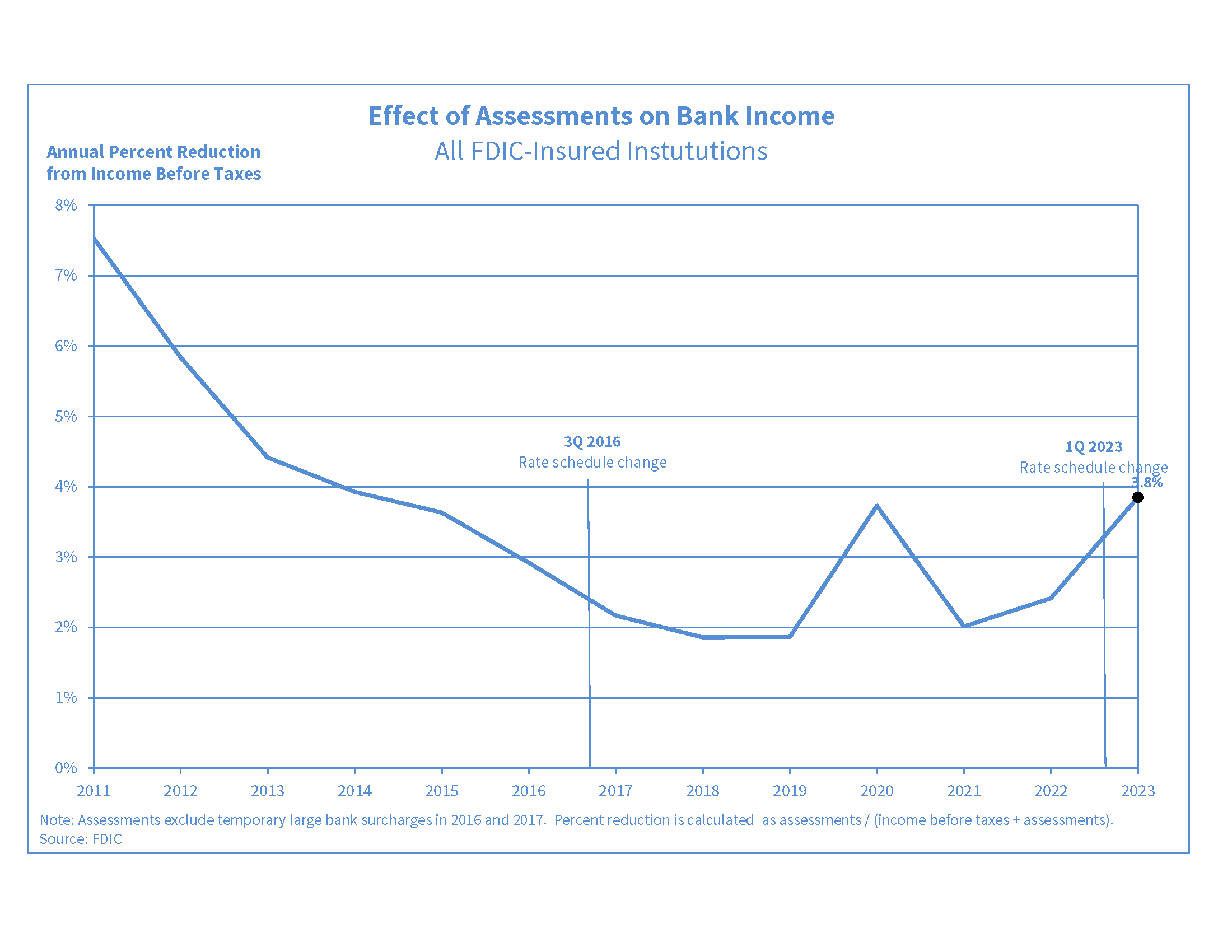

Federal Deposit Insurance Corporation - Wikiwand

Fdic Bank Insurance Marcus By Goldman Sachs

Fdic Vs Sipc Coverage And Limits Ally

Posting Komentar untuk "How To Calculate Fdic Insurance Coverage"